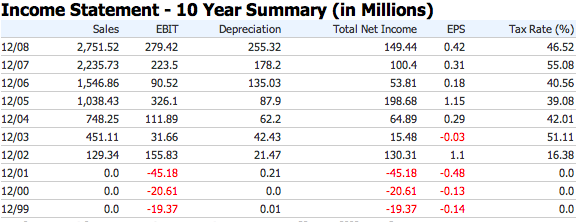

For those looking for exposure into a global marketplace, look no furthur than Fluor Corporation (FLR). This stock has reached lows on daily and weekly stoichastics and it’s primed to go up. The stock has been stagnant for 5 years. It reached highs in June 2008 but has continued back down to it’s 5 year lows. The financials on it look good. It has continued to increase earnings per share. The total net income has continued to increase every year.

Let’s take a look at what they do. If we read the finance summary on Yahoo’s Finance, it states it provides “engineering, procurement, construction, maintenance, and project management services worldwide.” It has multiple streams of income: oil & gas, industrial & infrastructure, government, and power. Their business seems quite complex. It’s a lot of logistics, engineering, and project management. However, it’s not any Enron. They are busy fudging numbers to get things looking good. They are providing a productive business that will create more industries. Engineering = good.

March 2, 2010, they were awarded a project valued at $450 million from Debswana Diamon Company Ltd. Here’s from the press release, “Jwaneng Cut 8 is at the forefront of a number of projects being developed by Fluor as part of a portfolio which includes a new diamond processing plant at the Orapa Diamond Mine and the expansion of the Morupule Coal Mine.”

February 28, 2010, they were awarded a project with the Singapore LNG Terminal Project. The plan is to have the terminal produce 3.5 million tons of LNG annually. I like these projects. They bring in a valued asset and Flour has a huge global presence.

Let’s take a look at their fourth quarter transcript. We’ve already reviewed their earnings so I’m looking for their guidance in the future and an explaination of waht they plan to do to keep up the growth. They have a huge backlog of mining projects including one with BHP Billiton’s Rapid Growth Project. In the United States and Europe, they are focusing on road and rail opportunities. They also are building wind farms in the coast of Scotland. They have continued contracts with Department of Energy and Defense.

Their guidance is very conservative at $2.80 to $3.20. They reduced it from $3.20 to $3.60. I think they can easily beat their numbers, but they are planning for the worse. It’s good to see a company that doesn’t exaggerate their numbers.

This looks like a good long-term hold. I’d suggest others to do their own due diligence. Boring companies like these never get heard of, but they continue to make money. I like the global presence and exposure to the US government. You are betting on US infrastructure and global growth. Both look good for the long-term. It can’t waddle at the $40s forever. I expect it has bottomed already, but if it does go furthur down, what’s keeping you from buying more of a bargain?