When I go to Walmart (WMT), I always see long lines of people buying tons of stuff in a huge warehouse that contains goods for eating, playing, working, and everything that you need to do whatever you want and need. It is one of the only warehouse where their are crowds of people that are coming in and out of a store. It sometimes is annoying to have to stop and go for the crowd of people because any Walmart is always so crowded with shoppers.

Also living nearby their distribution center for Walmart.com, I know that they are taking great strides to play in the internet market. They know that internet distribution is key but they also have the volume and revenue to play in a space only reserved for Amazon.com. The great thing about brick and mortar stores that have an online presence is they can offer you the option to not only order and deliver to your house but the more quick option would be the pick-up at their stores where you can get in two hours.

Remember, that they also have the Sam’s Club brand which competes with the fiercely competitive Costco warehouse stores. In February 2016, they started accepting Visa which means they allow all major credit cards which also include American Express, Discover, and Mastercard. This will allow a huge network of consumers to shop in their stores and it should mean more growth for the company overall.

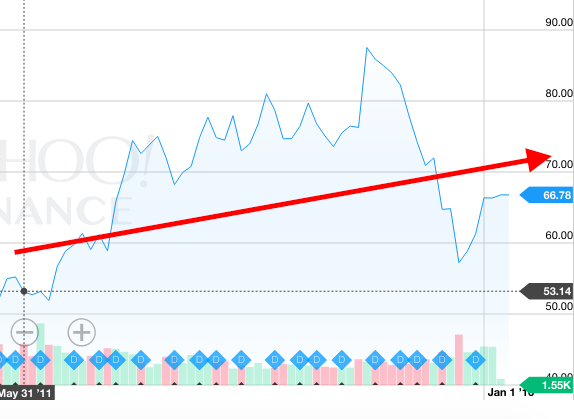

Employee morale is higher with proper hourly wages. They have gotten rid of the strange welcome people in their stores and replaced them with security to check the consumers purchased items before exiting the store. I feel that they are making all the necessary steps to perform at a much more competitive market. They recently had a beat in their quarterly earnings and I expect this to continue in the future. With a PE that is less than 15, there is really not much downside in the stock. It has already seen the worse and it will continue to improve going forward.